Running a restaurant involves more than just great food and customer service—it also requires financial accuracy. In fact, according to IRS data, restaurants are among the most audited small businesses in the U.S., largely due to common bookkeeping errors like poor tip reporting, untracked expenses, and cash mishandling.

As a certified U.S. accountant with over a decade of experience specializing in restaurant bookkeeping, I’ve seen how these errors can lead to tax penalties, cash flow crisis, and even business failure. In this article, we’ll dive deep into the common bookkeeping mistakes restaurant owners make, and how to avoid them in 2025’s regulatory landscape.

📊 Why Bookkeeping is Crucial for Restaurant Success

Bookkeeping is the financial backbone of any restaurant. Unlike many other businesses, restaurants deal with:

- High-volume, low-margin transactions

- Frequent vendor payments

- Tight inventory and perishables

- Seasonal spikes in revenue

Additionally, restaurants must stay compliant with:

- IRS payroll tax filings

- State and local sales tax

- 1099 reporting for contractors

- Wage and tip reporting under the Fair Labor Standards Act

Without accurate books, restaurant owners risk underpaying or overpaying taxes, mismanaging payroll, or losing track of profit margins.

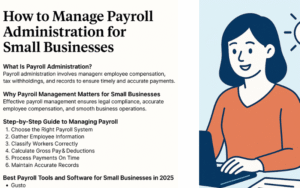

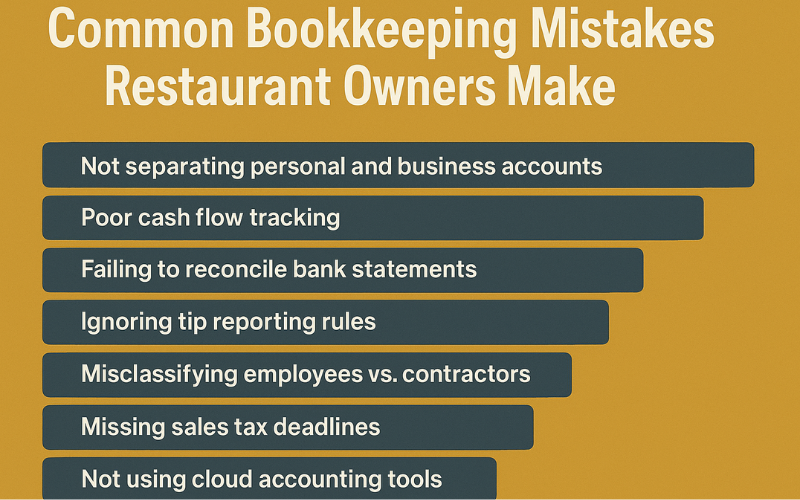

❌ Common Bookkeeping Mistakes Restaurant Owners Make

1. Not Separating Personal and Business Accounts

Mixing personal and business transactions confuses financial reporting and makes it difficult to track true business performance. The IRS also flags this as a red flag for audits.

Expert Tip: Open a dedicated business bank account and credit card—even if you’re a sole proprietor.

2. Poor Cash Flow Tracking

Restaurants often handle a high volume of cash transactions. Failing to track these correctly leads to inaccurate income statements and skews tax filings.

3. Failing to Reconcile Bank Statements

Not reconciling accounts monthly can lead to undetected errors, overdraft fees, or even fraud. Reconciliation helps match POS sales with bank deposits.

4. Ignoring Tip Reporting Rules

Restaurants must report employee tips accurately. Failing to track and report tips can result in underpaid payroll taxes and IRS penalties.

IRS Reference: Employers must file Form 8027 annually for tip allocation and report all tip income on employee W-2s.

5. Misclassifying Employees and Contractors

Mislabeling workers can result in unpaid employment taxes and IRS scrutiny. Remember: If you control how and when the work is done, they’re likely an employee.

6. Missing Sales Tax Deadlines

Each state has different filing requirements. Failing to collect or remit sales tax on time can incur interest and steep fines.

7. Not Using Cloud Accounting Tools

Manual systems (Excel or paper) are outdated. Cloud tools like QuickBooks Online or Xero automate reports, reconcile accounts, and integrate with POS systems.

8. DIY Bookkeeping Without Proper Training

Doing your own books without accounting knowledge is risky. You may miss out on deductions or make filing mistakes that cost you later.

🧾 IRS and Tax Implications of Bookkeeping Errors

Bad bookkeeping leads to tax consequences such as:

- IRS penalties for underreporting income

- Interest charges on late payroll or sales tax

- Audit risks for high cash discrepancies

- Loss of tax-deductible expenses due to poor records

Key Forms Involved:

- Form 941 (Quarterly Payroll Tax)

- Form 8027 (Tip Reporting)

- Form 1099-NEC (Contractor Payments)

Refer to IRS Pub 583 for recordkeeping guidelines.

💡 Expert Tips to Avoid Bookkeeping Mistakes

✅ Use Restaurant-Friendly Accounting Software

Choose tools that integrate with your POS system and bank accounts. QuickBooks Online, Xero, and MarginEdge are top choices for restaurants.

✅ Reconcile Monthly, Not Annually

Monthly reconciliation helps identify issues early and avoids surprises at year-end.

✅ Hire a Specialized Accountant

An accountant who understands restaurant margins, tax compliance, and labor laws can save you thousands in the long run.

✅ Integrate POS with Your Books

Link your POS (e.g., Toast, Square, Clover) to your accounting software for real-time reporting and reduced manual entry.

📈 How Bookkeeping Impacts Profitability in 2025

In 2025, precision is key. With rising labor costs, tighter margins, and supply chain volatility, bookkeeping affects:

- Cost of Goods Sold (COGS) management

- Labor cost tracking

- Budgeting and forecasting

- Loan readiness and investor confidence

Real-time financial visibility helps you react faster, plan better, and stay competitive.

🙋 Frequently Asked Questions (FAQs)

Can I use Excel for restaurant bookkeeping?

Yes, but it’s risky. Cloud tools offer automation, error detection, and better tax reporting capabilities.

What software is best for restaurant accounting?

QuickBooks Online (with a restaurant chart of accounts), Xero, and MarginEdge are top picks for restaurant owners.

How often should I update my books?

Ideally, update your books weekly, and reconcile them monthly. Waiting until year-end invites errors and missed deductions.

Can I claim all food wastage as an expense?

Partially. Food waste is deductible under COGS, but must be properly recorded and tied to inventory and sales data.

📝 Conclusion

Bookkeeping is the lifeblood of your restaurant’s financial health. From IRS compliance to profit optimization, it all starts with accurate records.

✅ Key Takeaways:

- Avoid DIY accounting without proper training

- Reconcile monthly and use cloud-based tools

- Report tips and sales tax accurately

- Separate business and personal finances

Ready to improve your restaurant’s financial hygiene?

📥 Download our free Bookkeeping Checklist for Restaurant Owners or book a consultation with a certified accountant today.