In the United States, sole proprietors—freelancers, consultants, small business owners—are responsible for reporting their income and paying taxes directly to the Internal Revenue Service (IRS). Unlike employees, there’s no employer withholding taxes from your paycheck. Instead, you must self-assess your earnings and submit a detailed tax return.

This guide explains everything U.S. sole proprietors need to know about filing taxes in 2025. From choosing the right forms and meeting IRS deadlines to deducting expenses and avoiding penalties, you’ll learn how to stay compliant and save money with confidence.

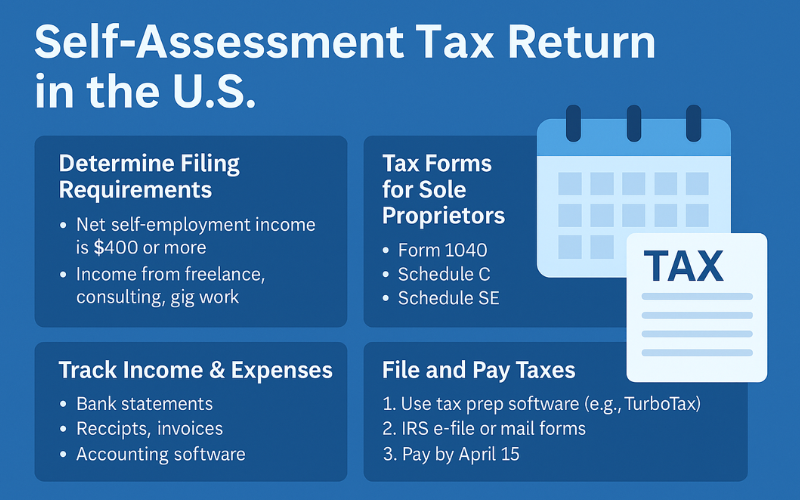

How to File a Self-Assessment Tax Return in the U.S.

Filing taxes as a sole proprietor involves reporting business income and expenses on your individual tax return.

Step 1: Determine Your Filing Requirements

You must file if:

- Your net self-employment income is $400 or more

- You earn income outside a regular W-2 job (e.g., freelance, consulting, gig work)

Step 2: Gather IRS Forms

Key IRS forms for sole proprietors:

- Form 1040 – Your main individual tax return

- Schedule C – Reports business income and expenses

- Schedule SE – Calculates self-employment tax

- Form 1040-ES – For estimated quarterly tax payments

🔗 Download IRS Forms

Step 3: Track Income & Expenses

Keep detailed digital records:

- Bank statements

- Receipts

- Invoices

- Accounting software logs (e.g., QuickBooks, FreshBooks)

This will help you accurately report income and claim all allowable deductions.

Step 4: File and Pay Taxes

Use tax prep software (e.g., TurboTax, H&R Block) or hire a professional. Submit electronically through IRS e-file or by mail.

Deadlines and Penalties for Late Submission

For the 2025 tax year, here’s what to remember:

| Tax Action | Deadline |

| Submit 1040 + Schedule C | April 15, 2026 |

| Make Estimated Tax Payments | April 15 / June 15 / Sept 15 / Jan 15 |

| Request Tax Extension | April 15, 2026 (Form 4868) |

Penalties for Late Filing or Payment:

- Failure-to-file penalty: 5% of unpaid taxes per month (max 25%)

- Failure-to-pay penalty: 0.5% of unpaid taxes per month

- Interest accrues daily on unpaid taxes

Avoid these by paying estimated taxes quarterly and filing on time.

Self-Assessment for Sole Proprietors vs. LLCs and Corporations

Sole Proprietors:

- Report income on Schedule C of Form 1040

- Pay income tax and self-employment tax (Social Security + Medicare)

- Simpler structure and fewer formalities

LLCs and Corporations:

- LLCs can be taxed as sole proprietors, partnerships, or S-corps

- Corporations file separate returns (Form 1120 or 1120-S)

- May offer tax benefits but involve more compliance

For tax savings, some sole proprietors elect S-Corp status via Form 2553. Consult a CPA before restructuring.

Tax-Deductible Expenses U.S. Sole Proprietors Can Claim

Maximizing your deductions is key to lowering your tax bill. The IRS allows deductions for expenses that are ordinary and necessary for your business.

Common Deductions Include:

- Office supplies and equipment

- Home office (use Form 8829 or simplified method)

- Business travel and vehicle mileage

- Phone and internet (business portion)

- Software subscriptions and tools

- Health insurance premiums (if self-employed)

- Professional fees (legal, accounting)

Using IRS Online Services

The IRS offers a range of digital tools to streamline filing:

- IRS Direct Pay – Pay taxes securely online

- Online Account – View payment history, balances, and notices

- Free File – Use IRS-partnered software if income is under $79,000

- E-File – Secure, faster filing with confirmation

Start at the IRS official website.

Common Mistakes to Avoid

Filing taxes as a sole proprietor has its challenges. Avoid these common errors:

- Not paying quarterly estimated taxes

- Forgetting to include 1099-NEC or 1099-K income

- Misreporting or overclaiming deductions

- Mixing business and personal expenses

- Not including self-employment tax in your calculations

Key Tax Terms Explained

Following are the key terms explained

Self-Employment Tax:

Covers Social Security and Medicare taxes. The rate is 15.3% on net earnings.

Estimated Taxes:

Quarterly prepayments to avoid underpayment penalties. Use Form 1040-ES to calculate.

Schedule C:

Reports your sole proprietorship’s income and deductible business expenses.

Form 1099-NEC / 1099-K:

Sent by clients or platforms showing payments made to you. Must be reported to the IRS.

Tips for Recordkeeping and Future Compliance

Good bookkeeping is essential for smooth filing and IRS compliance:

- Use digital software: QuickBooks, Wave, Zoho Books

- Separate business bank accounts

- Track mileage and receipts with mobile apps

- Store all records securely for 3–7 years

The IRS may audit sole proprietors more often than W-2 earners, so be organized.

Self-Assessment Tax Return Checklist for U.S. Sole Proprietors

| Task | Deadline |

| ✅ Track all income and expenses | Ongoing |

| ✅ Make quarterly tax payments | Apr 15, Jun 15, Sept 15, Jan 15 |

| ✅ File Form 1040 with Schedule C | By April 15, 2026 |

| ✅ Include Schedule SE | With Form 1040 |

| ✅ Pay self-employment tax | With your return |

| ✅ Use IRS online tools | As needed |

Final Thoughts: File Smart and Stay Compliant

For U.S. sole proprietors, filing a self-assessment tax return is a key responsibility—but it doesn’t have to be overwhelming. By staying organized, tracking deductions, making quarterly payments, and using the right forms, you can manage your tax obligations efficiently.

Don’t wait until the last minute—start early and take control of your taxes today.