Bookkeeping is the financial backbone of any business—recording daily transactions, tracking income and expenses, and ensuring compliance with tax obligations. For small business owners, however, managing books in-house can quickly become overwhelming. That’s where outsourcing bookkeeping comes in.

Outsourcing bookkeeping means hiring a third-party provider to handle your financial record-keeping. It’s a growing trend among UK-based small businesses, especially in 2025, as entrepreneurs seek smarter, cost-effective ways to stay financially organised and compliant with HMRC’s evolving regulations.

Why Bookkeeping Is Crucial for Small Businesses

Bookkeeping isn’t just a regulatory requirement—it’s essential for informed decision-making. Accurate books help you:

- Track cash flow

- Manage budgets

- Prepare for taxes (especially under HMRC’s Making Tax Digital [MTD] rules)

- Secure loans or investments

- Plan for growth

Yet, many small businesses struggle with the time, expertise, and tools needed to maintain accurate records—often leading to errors, missed tax deadlines, or uninformed decisions.

What Does It Mean to Outsource Bookkeeping?

Outsourcing involves partnering with a professional bookkeeping firm or accountant who manages your books remotely. Instead of hiring a full-time in-house bookkeeper, small businesses gain access to a team of qualified experts who handle everything from daily transaction logging to monthly reconciliations and year-end reporting.

Now, let’s explore the top benefits of outsourcing bookkeeping in today’s business environment.

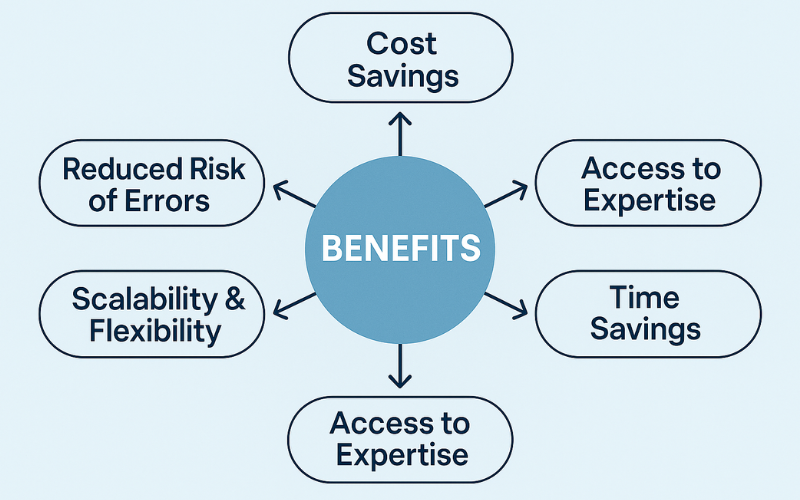

Top Benefits of Outsourcing Bookkeeping

Following are the top benefits of outsourcing bookkeeping

1. Cost Savings and Avoiding Full-Time Salary Expenses

Hiring an in-house bookkeeper means paying:

- A monthly salary

- Pension contributions

- Sick leave

- Holiday pay

- Office space and equipment

Outsourcing eliminates these overheads. You only pay for the services you need, whether it’s weekly transaction entries, monthly reports, or quarterly VAT submissions—freeing up funds for growth.

Pro Tip: Many UK-based firms like Sunrise Accountants offer flexible packages tailored to the size and needs of your business.

2. Access to Expert Financial Insight and Compliance Support

UK tax rules are constantly evolving, especially with MTD for Income Tax expanding in 2025. A professional bookkeeping partner stays on top of these changes, ensuring:

- Your records are always HMRC-compliant

- Deadlines aren’t missed

- Your deductions are optimised

You also gain access to financial insights that help you forecast, budget, and make smarter business decisions.

3. Time Savings to Focus on Core Business Activities

Every hour you spend reconciling bank statements is an hour lost on marketing, customer service, or innovation.

By outsourcing, you regain valuable time to:

- Grow your customer base

- Develop new products

- Improve service delivery

This time-saving benefit is especially critical for sole traders and startups with limited internal resources.

4. Scalability and Flexibility

As your business grows, so do your bookkeeping needs. Outsourced providers can easily scale with you:

- Adding payroll support

- Managing VAT returns

- Generating financial statements

You won’t need to retrain or hire new staff—just adjust your service level.

5. Reduced Risk of Errors and Fraud

Bookkeeping mistakes can lead to:

- Penalties from HMRC

- Overpaid taxes

- Poor financial decisions

Outsourcing to a qualified firm adds a layer of professionalism and internal checks. Reputable firms use secure, cloud-based tools that minimise human error and detect discrepancies early.

6. Access to the Latest Tools and Technologies Without Investment

Modern bookkeeping is tech-driven. From cloud accounting platforms like Xero and QuickBooks to automated bank feeds and AI-powered reconciliation, these tools improve speed and accuracy.

Outsourced bookkeepers come equipped with:

- Licensed software

- Data backup systems

- Secure portals

You benefit from cutting-edge tools—without the cost or learning curve.

Real-Life Example: How Outsourcing Helped a Local Café Owner in Manchester

Sarah, a café owner in Manchester, struggled to keep up with daily sales records and quarterly VAT filings. After incurring two late penalties from HMRC, she partnered with Sunrise Accountants for bookkeeping support.

Within three months:

- Her books were fully up to date

- VAT returns were filed accurately and on time

- She gained a monthly financial summary, helping her manage stock and cut unnecessary expenses

Sarah now focuses entirely on customer experience—while her finances stay compliant and transparent.

Addressing Common Concerns

Following are the commonly raised concern about outsourcing

1. Is My Data Secure?

Reputable bookkeeping providers use end-to-end encryption, secure servers, and GDPR-compliant practices. Ask about:

- Data access protocols

- Backup systems

- Secure communication channels

2. Will I Lose Control Over My Finances?

No—outsourcing doesn’t mean giving up control. You retain full access to reports, statements, and records. Most firms offer regular check-ins and dashboards to keep you in the loop.

3. Can I Trust a Third-Party Provider?

Trust is built through:

- Certifications (e.g. AAT, ACCA)

- Positive reviews

- Transparent service agreements

Start with a trial period or project-based contract to build confidence.

How to Choose the Right Bookkeeping Partner

Following are the things that needs to be addressed while choosing right bookkeeping partner

✔ Qualifications to Look For

- AAT Licensed Accountants

- Familiarity with UK GAAP and HMRC guidelines

- Experience with small business clients

✔ Local Compliance Knowledge

Firms based in the UK understand:

- MTD requirements

- VAT schemes (Flat Rate vs. Standard)

- Payroll and pension auto-enrolment

✔ Communication & Transparency

Choose a partner who:

- Responds quickly

- Offers regular reporting

- Explains financial concepts in plain English

Conclusion: Why Outsourcing is a Smart Move in 2025

As small businesses face tighter margins, stricter regulations, and greater competition, outsourcing bookkeeping offers a strategic edge. It’s not just about saving money—it’s about gaining time, accuracy, and clarity.

Whether you’re a freelancer, shop owner, or tech startup, outsourcing your books is a smart investment that pays off in control, compliance, and confidence.

Let Sunrise Accountants Help You

Looking for reliable, affordable, and HMRC-compliant bookkeeping support?

Sunrise Accountants specialises in small business bookkeeping, offering:

- Expert-led services

- Transparent pricing

- Customised support tailored to your growth

Learn more or request a free consultation today:

Let us handle your numbers—so you can focus on growing your business.