Gusto is a cloud-based payroll and human resources (HR) platform tailored for small and mid-sized businesses. Launched in 2012 (originally as ZenPayroll), Gusto has grown to serve over 300,000 businesses across the United States.

It offers an all-in-one service that handles payroll processing, tax filings, and even employee benefits administration through a simple online interface. Gusto is designed for employers who want to streamline payroll and HR tasks without needing specialized accounting knowledge – an ideal fit for startups, small companies, and growing businesses that require full-service payroll with minimal hassle.

The tool’s focus on ease-of-use and comprehensive features makes it popular among businesses that may not have dedicated HR or finance departments.

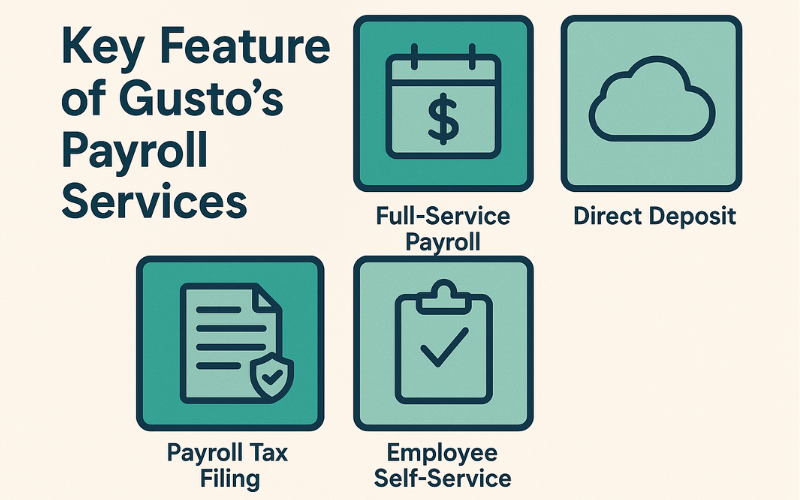

Key Features of Gusto’s Payroll Services

Gusto provides a rich set of features to automate and simplify payroll and related HR processes. Its key offerings include:

Full-Service Payroll & Tax Filing:

Gusto handles payroll calculations and runs for W-2 employees and 1099 contractors with ease. Employers can run payroll an unlimited number of times each month at no extra cost, and Gusto’s AutoPilot feature can even automate recurring payroll runs. All federal, state, and local payroll taxes are calculated, withheld, and filed automatically by Gusto, helping businesses stay compliant with tax regulations (all year-end W-2 and 1099 forms are prepared and filed as well). This full-service tax compliance – including new-hire reporting to states – means employers don’t have to worry about quarterly filings or tax deadlines, as Gusto takes care of it.

Direct Deposit & Payment Options:

Gusto offers convenient direct deposit for employees. In the base plan, payroll payments are processed with a two-day direct deposit timeline, while higher plans enable next-day deposits for faster payroll execution. Employees can also use the Gusto Wallet app to access earned wages (for example, through features like cash-outs before payday) and view pay stubs. If needed, Gusto can handle paper check generation (employers print checks themselves) or other payment methods, though it does not provide check delivery services (a difference from some traditional providers).

Benefits Administration:

A major differentiator for Gusto is its built-in benefits management.

- Gusto can administer a variety of employee benefits, including health, dental, and vision insurance, as well as 401(k) retirement plans, health savings accounts (HSAs), flexible spending accounts (FSAs), commuter benefits, and workers’ compensation insurance.

- Businesses can choose to offer these benefits through Gusto’s partnerships and broker services, often with no extra administrative fee for benefits administration on top of the payroll subscription. (Note: Health insurance through Gusto is available in most states, and the platform supports integration with third-party brokers for broader coverage.)

- In addition, Gusto handles related compliance like Cobra administration for departing employees on certain plans. By centralizing benefits enrollment and deductions within the payroll system, Gusto makes it easier for small companies to offer big-company perks without separate HR software.

Time Tracking and PTO Management:

For businesses that need to track hours and attendance, Gusto offers built-in time tracking tools (included in its mid-tier and above). Employees can clock in/out or log hours which sync directly to payroll calculations. This is useful for hourly staff or those who track billable hours and projects. Gusto’s time tracking includes features like project tracking and even a kiosk mode (turning a tablet into a time clock) on higher plans.

The platform also manages paid time off (PTO) policies – you can set PTO accrual rules, and employees can request time off through their profiles. Approved PTO is reflected in payroll automatically. If a company already uses dedicated timekeeping software, Gusto integrates with popular tools like TSheets/QuickBooks Time, Homebase, and When I Work, ensuring a smooth flow of hours data into payroll.

Employee Self-Service & Onboarding:

Gusto provides an employee self-service portal where staff can view pay stubs, W-2s, and manage their personal details. During onboarding, new hires can e-sign documents (like W-4 and I-9 forms), enter direct deposit info, and even select benefits online – Gusto creates a streamlined onboarding checklist for each new employee.

The system also handles mandatory new hire reporting to government agencies automatically. Beyond payroll, Gusto includes basic HR tools such as org charts, employee directories, and the ability to store HR documents. In higher plants, it offers employee surveys and custom admin permissions for delegating tasks.

While it’s not a full HRIS (e.g., it lacks in-depth performance management), these features cover the essentials for small teams to manage their workforce.

Compliance and Extras:

Gusto stays up to date with labor and tax law changes, helping employers remain compliant. It sends compliance alerts and to-dos (for example, reminding when to renew state unemployment insurance rates or update labor law posters). In its Premium tier, Gusto even provides access to certified HR professionals and an HR resource center for guidance on complex issues or policies.

All plans include basic workers’ comp insurance integration (pay-as-you-go billing through partners), and Gusto can also assist with Gusto Global services – an Employer of Record service (via partner) to hire employees in other countries, or tools to pay international contractors.

For companies engaging overseas contractors, Gusto supports international payments in 100+ countries (available as an add-on). These extras make Gusto more than just a payroll processor – it can serve as a lightweight HR hub for small businesses.

Integrations:

Gusto easily connects with other business software. It integrates with leading accounting platforms like QuickBooks Online, Xero, and FreshBooks, automatically syncing payroll expenses to the general ledger. It also connects with time-tracking apps, point-of-sale systems, and HR tools such as BambooHR and Lever. This flexibility ensures that Gusto can fit into a company’s existing software ecosystem. For example, if you use Xero for accounting, Gusto’s integration will journal every payroll run into Xero accounts seamlessly. Such integrations save time and reduce data entry errors across systems.

Pricing Plans and Inclusions

Gusto offers several pricing plans to accommodate different business needs. All plans include the core payroll features, tax filing, direct deposit, and employee self-service, but higher tiers add more HR and support perks. As of 2025, the pricing and key inclusions are:

- Simple Plan: $49 per month base fee plus $6 per person (employee or contractor) per month. This is the entry-level plan suitable for small businesses with straightforward needs. It includes full-service payroll for a single state (only one state tax jurisdiction supported), all tax filings, direct deposit (with a 2-day processing timeline), employee self-service portal, basic hiring and onboarding tools, and full customer support. Simple plan users can manage employee profiles, use Gusto’s health benefits and workers’ comp integration, and run unlimited payrolls. However, some advanced features (like time tracking and next-day deposit) are not included in Simple.

- Plus Plan: $80 per month base fee plus $12 per person per month. The Plus plan is Gusto’s mid-tier offering and the most popular choice for growing businesses. It includes everything in Simple, plus the ability to run multi-state payroll (for companies with employees in more than one state). It also upgrades direct deposits to next-day speed. The Plus plan adds a suite of HR features: paid-time-off management and policies, workforce costing reports, project tracking and time tracking tools built-in, employee surveys, and advanced onboarding customizations (like being able to send offer letters and onboarding checklists). This plan is ideal for companies that need more robust HR and time-tracking functionality integrated with payroll.

- Premium Plan: Custom pricing. (Typically around $180 per month base plus $22 per person per month, based on recent reports.) The Premium plan is Gusto’s top-tier service, geared towards larger businesses or those wanting dedicated support. It includes everything in Plus, plus a number of VIP features: access to certified HR professionals for HR guidance, a dedicated customer success manager, priority support responses, and access to a comprehensive HR resource center with templates and policy guides. Premium also may offer extras like assistance with payroll migration from another system and the ability to integrate a third-party health insurance broker if needed. Essentially, this plan layers on advanced HR advisory services and more personalized support. Pricing for Premium is usually obtained via quote, and it tends to be cost-effective only for larger teams that will utilize the extra HR services.

- Contractor-Only Plan: $0 base fee (no monthly base) and $6 per person (contractor) per month. This special plan is designed for companies that only pay independent contractors (and no W-2 employees). It allows unlimited contractor payments and handles the filing of 1099 forms at year-end. The Contractor plan includes features relevant to contractors, such as tracking contractor payments and collecting W-9 forms, but does not include W-2 payroll processing. Notably, contractor payments via Gusto can be made to U.S.-based contractors, and an add-on is available to pay international contractors as well. (If at any point a company hires a W-2 employee, they would need to upgrade to one of the core plans above.)

What each plan includes: All Gusto plans come with full-service payroll (tax filing, direct deposit, unlimited payroll runs, new hire reporting, etc.), employee self-service accounts, basic onboarding tools, and default support. The differences are mainly in HR features and support level.

For instance, multi-state payroll capability and time tracking are unlocked at Plus level and above. Premium is the only plan with direct HR expert consultations and a dedicated rep. The pricing is transparent and month-to-month – Gusto does not require long-term contracts, and you can cancel or change plans as needed.

Additionally, Gusto often runs promotions (such as discounting the first month or two, or referral credits), but the figures above are the standard rates as of 2025.

User Interface and Ease of Use

One of Gusto’s strongest points noted in reviews is its user-friendly interface. The platform is accessed through a web browser (there’s no need to install software), and the design is clean and modern. Navigation is straightforward, with a dashboard that highlights upcoming tasks (like next payroll due date or tax filings) and a clear menu for Payroll, Benefits, Reports, etc.

Many users praise Gusto’s intuitive layout, commenting that even non-technical people or first-time payroll admins find it easy to operate. For example, setting up a new employee in Gusto is as simple as filling out a guided form, and running payroll can be done in just a few clicks once employees’ hours or salaries are entered.

Automation and Guidance

Gusto’s interface emphasizes automation and guidance. It provides tooltips and explanations for payroll concepts, which is helpful for small business owners handling payroll themselves. The system also includes checklists (e.g., a step-by-step onboarding checklist for new hires) that make it clear what information is needed. Overall, the learning curve is very short – Business News Daily noted that Gusto’s software “is easy to use for payroll and HR tasks,” making it accessible even to those without an HR background.

Usability

However, there are a few drawbacks in usability to note.

- First, Gusto currently does not offer a dedicated mobile app for administrators. Employees have the Gusto Wallet app for paystubs and financial wellness, but administrators must use the web portal (which is mobile-responsive, but not a native app).

- Some users wish for a mobile app to run payroll on the go, though the web interface can be accessed via a mobile browser in a pinch. Secondly, while the interface is generally simple, it lacks a global search function – you cannot type in a keyword to quickly jump to a specific employee or setting.

- This means occasionally clicking through menus to find a less common setting, which a few reviewers cited as a minor inconvenience.

In terms of speed and reliability, Gusto’s cloud software is quite responsive. Pages load quickly, and payroll runs are processed promptly. The service is also reliable with 99.9% uptime, so users rarely report downtime issues. Navigation between payroll, benefits, and reports is seamless since everything is integrated. Overall, the user experience is streamlined and well-designed for efficiency. Gusto earns high marks in customer reviews for making payroll “simple and even enjoyable” with an interface that’s far less intimidating than legacy payroll systems.

Customer Support and Service

Gusto provides several channels for customer support, and overall its service is well-regarded. Users on the base plans have access to support via phone, email, and live chat during business hours. Specifically, Gusto offers phone and chat support Monday through Friday, typically from 6am to 5pm Pacific Time (9am-8pm Eastern).

Email support and an online help center are also available for less urgent inquiries. The online help center includes a comprehensive library of guides and FAQs, covering topics from payroll setup to troubleshooting issues; many common questions can be answered through these resources without needing to contact support.

Friendly Chit-Chat

In practice, Gusto’s support team has a reputation for being friendly and knowledgeable. In one hands-on review, the tester reported that live chat connected them to a human support agent in under a minute, and the agent was able to resolve questions promptly.

Phone support generally has short wait times as well (especially for Premium plan customers, who get priority in the queue). Gusto also assigns new customers an implementation advisor who helps with initial account setup and first payroll run, which can be very reassuring for those new to the software.

Weekend Support

That said, there are some limitations. Gusto’s support is not 24/7 – weekend support is limited (live chat is available for a few hours on Sunday, but phone support is weekdays only). This contrasts with some larger competitors that have round-the-clock support. A few users have also left negative reviews citing support issues, such as slow resolution of complex problems or having to speak with multiple reps for an answer. While these instances seem to be the exception rather than the norm, it’s worth noting that as Gusto has scaled to hundreds of thousands of clients, some growing pains in customer service have been reported.

Dedicated Account Manager

For Premium plan subscribers, Gusto’s support includes a dedicated account manager and HR professionals on call, which significantly boosts the level of service.

- Many small business users, however, find that even the standard support is very good – issues are resolved in a timely manner and the support staff is well-versed in payroll matters.

- Gusto has also invested in proactive support: for example, if there’s a tax law change in your state, Gusto might send out an alert or even have support reach out with guidance on any actions needed.

- Overall, customer service is a strong point for Gusto, frequently earning high satisfaction scores (one independent review gave Gusto a 9/10 for support quality), provided your support needs fall within their operational hours.

Pros and Cons of Gusto

Like any software, Gusto comes with its advantages and disadvantages. Here is a summary of the major pros and cons based on expert evaluations and user reviews:

Pros

- Comprehensive, Automated Payroll: Gusto offers full-service payroll with automatic tax filings in all jurisdictions, which greatly reduces manual work and the risk of errors. Features like AutoPilot (automated payroll runs) and built-in W-2/1099 filing at year-end make payroll processing nearly hands-free for routine pay cycles.

- User-Friendly Interface: Both experts and end-users consistently praise Gusto’s intuitive and clean interface. Navigation is straightforward, and the software includes helpful prompts and tutorials. Even those without payroll experience find it easy to set up and use.

- Integrated Benefits & HR Features: Gusto stands out for bundling payroll with benefits administration (health insurance, retirement plans, etc.) and basic HR tools. This all-in-one approach means small businesses can manage hiring paperwork, employee benefits, time tracking, and payroll all from one platform, rather than using separate services.

- Transparent, Affordable Pricing for Small Teams: Gusto’s pricing is clearly published, with no hidden fees. The month-to-month plans and reasonable base fee make it attractive to startups and small businesses. There’s no extra charge for features like multiple payroll runs, and even the mid-tier plan remains competitively priced for the value it provides. Many consider it a cost-effective solution given the breadth of services (payroll + HR) included.

- Strong Integrations: Gusto integrates with major accounting software (e.g., QuickBooks, Xero) and other business tools, ensuring that payroll data flows smoothly to the rest of your systems. This saves time and avoids data entry mistakes. It also has an open API for custom integrations.

- Employee Experience Perks: Employees get benefits from Gusto too, such as access to the Gusto Wallet app for financial wellness, the ability to view and download pay stubs and tax forms online, and even options like on-demand pay (if the employer enables it). This can boost employee satisfaction, since they have transparency and control over their payroll and benefits info.

- Reliable Compliance and Accuracy: Gusto’s focus on compliance (automatic updates for tax law changes, built-in new hire reporting, proper handling of deductions) means businesses can trust it to keep them on track with regulations. The platform minimizes mistakes by design, and in the rare case of an error, Gusto has been noted to help resolve tax issues. (In contrast, some services leave compliance more to the employer – Gusto’s hands-on approach is a plus.)

Cons

- Limited Advanced HR Features: While Gusto covers the basics of HR, it does not offer some advanced HR functionalities that larger organizations might need. For example, it lacks built-in performance management, advanced training/tracking modules, or robust recruiting ATS features. Companies that require comprehensive HRIS functionality may need to integrate a separate system or upgrade to a PEO service beyond Gusto’s scope.

- No Dedicated Admin Mobile App: Gusto does not have a mobile app for administrators or owners to run payroll or adjust settings on the fly. Admins must use a web browser. In comparison, a few competitors (and even Gusto’s own employee-facing app) offer mobile convenience. This is a minor inconvenience, but worth noting for those who prefer managing tasks via smartphone.

- Higher Tiers Can Be Pricey: Gusto’s Premium plan, while optional, is relatively expensive with a high base fee. For very small businesses, that tier likely isn’t justifiable. Some users point out that once a company grows larger (and might consider Premium for the added HR support), Gusto’s cost starts to approach that of enterprise payroll providers, potentially reducing its small-business price advantage. Essentially, value for money decreases at the top tier – you pay a premium for the VIP service.

- Limited Global Payroll Capabilities: Gusto is primarily focused on U.S. payroll. It does support international contractor payments and offers a partner solution for hiring internationally (through the Gusto Global program), but it cannot natively pay W-2 employees outside the U.S.. Companies with international full-time staff will need another solution or service for those employees. In contrast, some larger providers (like ADP or Papaya Global) have more robust multi-country payroll options.

- Some Features Only in Higher Plans: Certain useful features like built-in time tracking, PTO requests, and multi-state payroll are not available in the Simple plan. This means some small businesses might have to upgrade to Plus to get functionality that, in other solutions, might be included in a base package. For example, if you have even one employee in another state, Gusto effectively requires moving to the $80/month plan for compliance. While the Plus plan is feature-rich, the jump from Simple could be a factor for very price-sensitive users.

- Customer Support Not 24/7: As noted, Gusto’s support is weekday business-hours only (with limited Sunday chat). If you often need assistance during off-hours or have critical payrolls at odd times, this could be a drawback compared to providers that have 24/7 support hotlines. Additionally, a few users have reported inconsistent support experiences when dealing with complex issues, suggesting room for improvement in scaling support as the customer base grows.

Overall, the pros of Gusto – especially its ease of use and comprehensive service for small businesses – far outweigh the cons for its target market. Many reviewers conclude that Gusto delivers exceptional value and convenience for small and growing companies, while acknowledging that very large or complex organizations might outgrow its feature set.

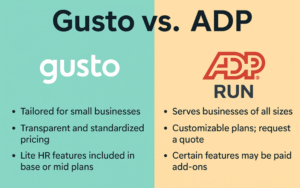

Comparisons with Similar Payroll Tools

To put Gusto into perspective, it’s helpful to compare it with other popular payroll solutions. We will look at how Gusto stacks up against Intuit QuickBooks Payroll, ADP, and Paychex, since these are well-known alternatives.

Each of these competitors offers payroll services with their own strengths, and the best choice can depend on a business’s specific needs (such as budget, desired features, company size, etc.). Below, we break down the comparisons and then provide a summary table of key features and pricing.

Key Feature and Pricing Comparison Table

The following table provides a side-by-side comparison of Gusto, QuickBooks Payroll, ADP (RUN for Small Business), and Paychex (Flex) on some key aspects:

| Aspect | Gusto (Payroll) | QuickBooks Payroll (Intuit) | ADP RUN (Small Biz) | Paychex Flex (Small Biz) |

| Starting Price | $49/mo base + $6 per employee (Simple plan) | $45/mo base + $6 per employee (Core plan) | Custom quote (approx. $79/mo + $4/employee) | $39/mo base + $5 per employee (Essentials) |

| Payroll Tax Filing | Yes – Full-service tax filing in all 50 states; W-2/1099 included in price. | Yes – Full-service, all states; year-end forms included. Extra ~$12/state for multi-state on lower tiers. | Yes – Full-service (all states). Note: Often charges extra for year-end forms (e.g. W-2 processing). | Yes – Full-service (all states). Year-end tax forms may incur additional fees depending on plan. |

| Automated Payroll | Yes – “AutoPilot” can run payroll automatically each cycle. | Yes – Auto-payroll for salaried employees on all plans. | Yes – Recurring auto-payroll available (configurable with ADP). | Yes – Recurring/automated runs supported via Flex platform. |

| Direct Deposit Speed | 2-day standard (Simple); Next-day on Plus/Premium. | Next-day standard (Core); Same-day available on Premium/Elite. | 2-day standard; same-day deposit available only in certain premium offerings. | 2-day standard funding; can process faster deposits with premium services (varies by client setup). |

| Benefits Administration | Yes – In-platform health, dental, vision in many states; 401(k), HSA, FSA, workers’ comp integration. | Yes – Offers health insurance, 401k, etc. via partner integrations (e.g., SimplyInsured, Guideline). | Yes – Wide range of benefits and insurance available (often as add-ons or separate services through ADP). | Yes – Full suite (insurance, 401k, etc.) available; often bundled or add-on services through Paychex. |

| Time Tracking | Yes – Built-in time tracking & PTO management on higher plans (Plus/Premium). | Yes – Included via QuickBooks Time integration on Premium/Elite; not in Core by default. | Available – Offered as an add-on module (ADP Time & Attendance) or included in higher plan bundles. | Available – Built-in time tracking in higher-tier plans or as add-on (Paychex Flex Time). |

| HR Features | Basic HR (org charts, onboarding e-docs) in lower tiers; HR advisors & resources in Premium. | Basic HR tools; HR support center in Premium; HR advisor in Elite. | Extensive HR offerings (recruiting, talent, etc.) available; many HR features require upgraded ADP plans or add-ons. | Strong HR support available; higher tiers include HR consultant access and extra HR tools (e.g., handbook, compliance). |

| Customer Support Hours | M–F, business hours (extended); live chat limited on weekends. Priority support for Premium tier. | M–F support (business hours for Core; 24/7 phone support included with Elite plan). | 24/7 phone and chat support available for ADP clients. Typically dedicated rep assigned. | 24/7 phone and chat support. Dedicated payroll specialist assigned for many plans. |

| Ideal For | Small to mid-sized businesses (1–200 employees) seeking an all-in-one payroll + basic HR solution with transparent pricing. | Small businesses, especially those using QuickBooks for accounting, or needing same-day pay and Intuit ecosystem integration. | Businesses of any size that may grow or need advanced HR; fast-growing companies that want scalable, customizable payroll/HR services. | Small to mid-sized businesses that want full-service payroll with hands-on support; companies okay with quote-based pricing for a tailored package. |

Sources: Company websites and official pricing (as of 2025), plus comparisons from FitSmallBusiness and Forbes Advisor for pricing and feature differences.

Suitability for Different Business Sizes

Gusto is particularly well-suited for small businesses and startups. These organizations often have limited HR/payroll staff (sometimes just the owner handling payroll) and need a solution that is easy to use yet comprehensive. Gusto hits that sweet spot by offering a full-service solution out-of-the-box — you can run payroll, manage taxes, and offer benefits all from one platform, which is a huge advantage for a small company trying to minimize administrative overhead.

Its transparent pricing and month-to-month plans are also friendly to small businesses and new startups that need to watch costs and avoid long commitments. Additionally, Gusto’s emphasis on user experience means less time spent training or figuring out the system, which is ideal for a busy founder or small team. It’s no surprise that Gusto has become a go-to recommendation for startups and companies with under 50 employees.

Medium Sized Businesses

For medium-sized businesses (perhaps those in the low hundreds of employees or spread across multiple states), Gusto can still be a strong solution, especially with the Plus or Premium plans. These tiers allow multi-state payroll and provide more HR support. Companies that are growing and adding more employees across different locations will benefit from Gusto’s ability to scale its payroll volume and maintain compliance in various jurisdictions.

However, medium-sized companies should evaluate if Gusto’s feature set meets all their needs. For example, if a company reaches a size where advanced HR functions (like performance reviews, extensive permission controls, or in-depth analytics) become important, they might find Gusto’s offerings a bit limited. In many cases though, Gusto can comfortably handle a mid-sized firm’s payroll/HR needs, up to a few hundred employees, before any limitations are felt. FitSmallBusiness, for instance, found Gusto to be the best overall choice for small to mid-sized companies compared to ADP and Paychex, given its balance of features and cost

Larger Organizations

When it comes to larger organizations, the equation changes. Enterprises or businesses with hundreds to thousands of employees (or very complex payroll requirements) might find Gusto lacking some advanced capabilities.

- Large organizations often need things like: multi-team role-based access, custom reports at scale, complex benefit structures, union or job costing payroll, global payroll, advanced security certifications, etc. Gusto is continuously adding features, but historically it has not targeted the true enterprise market.

- In fact, Gusto’s largest plan (Premium) encourages companies over a certain size to talk to sales for a “Select” plan, which is a custom offering for 50+ employees. This suggests that Gusto is willing to cater to somewhat larger clients by negotiation, but it’s still not as enterprise-focused as, say, ADP or Workday.

- Larger companies often prefer ADP or Paychex (or other enterprise HRIS/payroll systems) because those systems are proven at scale and come with dedicated account management, implementation teams, and advanced feature sets to handle complex needs.

Industries

Moreover, industry-specific needs can also influence suitability. Gusto is very popular among tech startups, creative agencies, retail shops, restaurants (to an extent), and professional services firms. It’s excellent for companies that want to offer good benefits and modern perks to employees without a huge HR team.

However, if a company is in an industry with specialized payroll (like construction with certified payroll reports, or healthcare with shift differentials and compliance tracking), they may need to ensure Gusto can handle those scenarios or consider more specialized solutions. Often, larger enterprises or those with unionized workforces will lean towards providers like ADP, Paychex, or UKG that have modules for those complexities.

Conclusion:

In the landscape of payroll providers, Gusto has carved out a reputation as an innovative, small-business-friendly platform. Its combination of full-service payroll, integrated benefits, and user-centric design makes it a compelling choice for companies that want to simplify people’s operations. While it may not (yet) have all the bells and whistles for very large enterprises, Gusto excels in its domain of serving small to mid-sized businesses. Its strengths in automation, compliance, and customer experience have been affirmed by many users and reviewers – often outperforming more tenured competitors on those fronts. On the other hand, businesses should weigh Gusto’s limitations (advanced HR features, mobile admin access, etc.) against their needs.

Overall, this detailed review highlights that Gusto is a robust payroll and basic HR tool that brings a lot of value, especially considering its price point. For most small businesses and startups, Gusto can save significant time and reduce errors in running payroll, all while keeping employees happy and supported. As always, it’s wise to compare it with alternatives (like QuickBooks Payroll, ADP, and Paychex as we’ve done above) to ensure it’s the right fit – but Gusto’s blend of simplicity and power has made it a top recommendation in 2025 for those looking to streamline their payroll and HR processes.