Knowing your contribution margin can make or break your pricing, budgeting, and expansion strategies. But how do you calculate it accurately—and what does it tell you about your business? Let’s break it down.

📌 Real-World Scenario:

Imagine you run a small bakery. You’re thinking about launching a new line of premium cupcakes, but you’re unsure if they’ll actually increase your profit. This is where contribution margin steps in—it helps you figure out whether the revenue from your cupcakes will truly “contribute” to covering your fixed costs and boosting your bottom line.

What Is Contribution Margin?

Contribution margin is the amount left from your sales revenue after subtracting variable costs. It shows how much money you have to cover fixed costs and generate profit.

✅ Definition:

Contribution Margin = Sales Revenue – Variable Costs

It’s a key metric in cost-volume-profit (CVP) analysis—used for pricing decisions, forecasting, and break-even analysis.

❓ Contribution Margin vs. Gross Margin:

- Gross Margin includes all costs of goods sold (COGS), both fixed and variable.

- Contribution Margin focuses only on variable costs, making it more relevant for internal decision-making.

Contribution Margin Formula

There are three main ways to calculate it:

- Total Contribution Margin:

Contribution Margin = Sales Revenue – Variable Costs - Contribution Margin Per Unit:

CM per Unit = (Price per Unit – Variable Cost per Unit) - Contribution Margin Ratio (CM Ratio):

CM Ratio = (Contribution Margin ÷ Sales Revenue) × 100

This ratio helps compare profitability across products and periods.

🔍 Step-by-Step: How to Find Contribution Margin

✅ Step 1: Identify Sales Revenue

Determine the total revenue generated from selling your product or service.

✅ Step 2: Calculate Variable Costs

Include only costs that vary with sales volume—like materials, commissions, packaging, etc.

✅ Step 3: Apply the Formula

Let’s walk through an example:

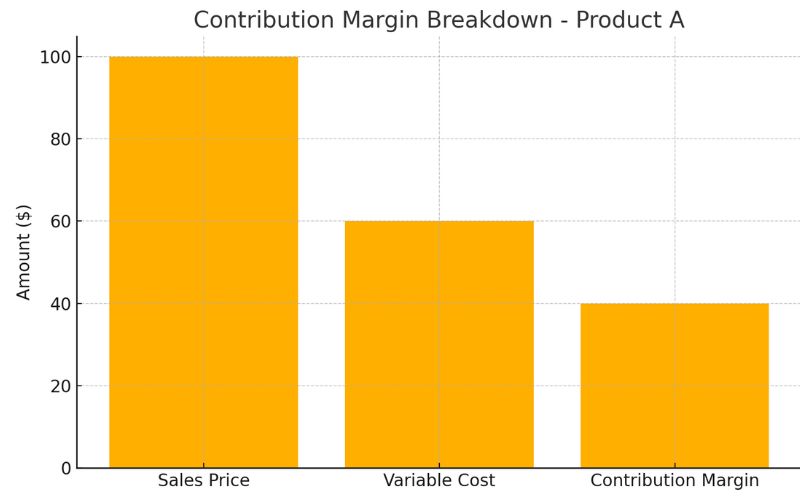

Product A

- Sales Price: $100

- Variable Costs: $60

→ Contribution Margin = $100 – $60 = $40

→ CM Ratio = ($40 ÷ $100) × 100 = 40%

This means 40% of each sale contributes to covering fixed costs and profit.

🔎 Interpreting the Results

- High Contribution Margin (e.g., 70%): Strong product profitability; better at covering fixed costs.

- Low Contribution Margin (e.g., 20%): Thin buffer; indicates the need to reduce costs or raise prices.

Use CM to:

- Make pricing decisions

- Identify unprofitable products

- Plan for break-even points and expansions

⚠️ Common Mistakes to Avoid

- Mixing fixed and variable costs: Don’t include rent, salaries, or insurance in variable costs.

- Ignoring step-variable or semi-variable costs: Understand cost behavior patterns before categorizing.

- Overlooking opportunity costs: Consider what you’re giving up to produce a low-margin product.

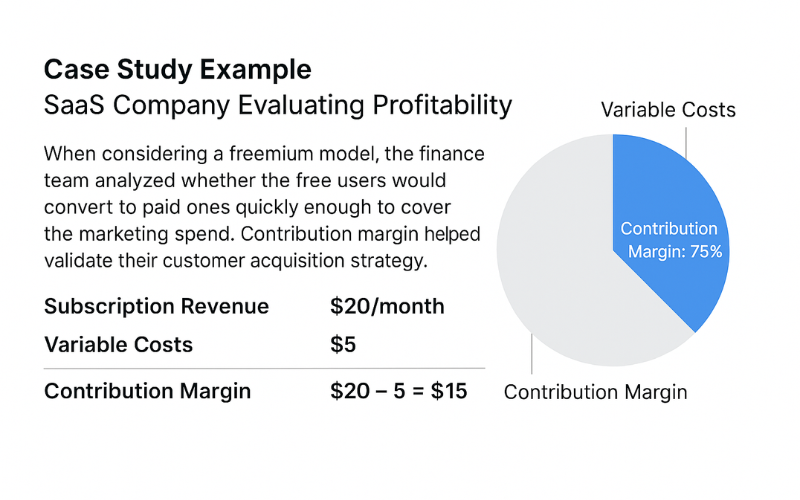

📈 Case Study: SaaS Startup Example

A SaaS company charges $20/month for a subscription. Variable costs per user (server load, payment processing, customer support) total $5.

CM = $20 – $5 = $15 → CM Ratio = 75%

When considering a freemium model, the finance team analyzed whether the free users would convert to paid ones quickly enough to cover the marketing spend. Contribution margin helped validate their customer acquisition strategy.

🛠️ Tools & Templates

- Excel Templates – Pre-built CM calculators

- Accounting Software – QuickBooks, Xero, and FreshBooks often include CM reports

- Online Calculators – Search “contribution margin calculator” for plug-and-play tools

❓FAQs

1. Is contribution margin the same as profit?

No. Contribution margin is what’s left after variable costs. Profit comes after both variable and fixed costs are deducted.

2. Can contribution margin be negative?

Yes—and it’s a red flag. A negative CM means your product doesn’t even cover variable costs.

3. How is contribution margin used in break-even analysis?

The break-even point = Fixed Costs ÷ CM per unit. This tells you how many units you need to sell before you start making profit.

4. What’s a good contribution margin ratio?

It varies by industry, but typically 30–60% is considered healthy. Software products often have higher CM due to lower variable costs.

5. How can I improve my contribution margin?

By increasing prices, reducing variable costs, or focusing on high-margin products.

Conclusion

Whether you’re a startup founder or a business student, understanding how to find contribution margin empowers you to make better, data-driven decisions. From pricing strategy to product selection, contribution margin gives you a clear lens into your true profitability.

Start using this powerful metric today—and let every sale count toward your business growth.